Pritti MistryBusiness reporter and Faisal IslamEconomics editor

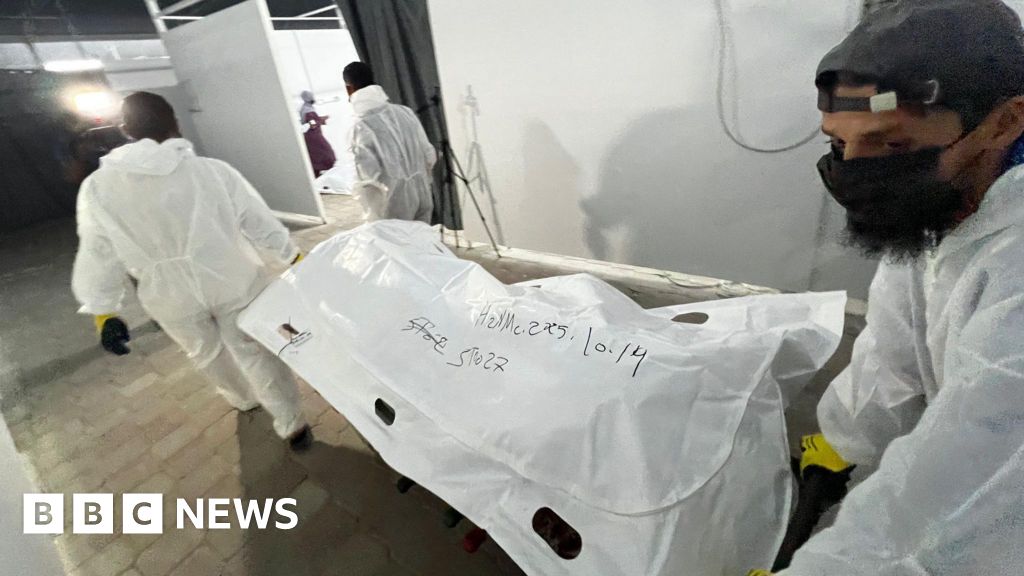

Britain is targeting Russia's largest oil companies and the country's "shadow fleet" of oil tankers in a bid to cut off Vladimir Putin's ability to fund the war in Ukraine.

The UK government is also pursuing a major Indian oil refinery and four Chinese oil terminals in a package of 90 new sanctions.

Chancellor Rachel Reeves said the move was expected to have a significant impact on Russia's economy and its ability to sustain military operations in Ukraine.

"We are sending a clear signal: Russian oil is off the market," she said ahead of a meeting in Washington DC with global counterparts to discuss Russian sanctions.

Reeves said the government was "significantly stepping up the pressure on Russia and Vladimir Putin's war effort."

Russia's two largest oil companies - Lukoil and Rosneft - will be hit with sanctions, Reeves said on the sidelines of the International Monetary Fund's (IMF) annual meeting.

"At the same time, we are ramping up pressure on companies in third countries, including India and China, that continue to facilitate getting Russian oil onto global markets," she said.

"There is no place for Russian oil on global markets and we will take whatever actions are necessary to destroy the capability of the Russian government to continue this illegal war in Ukraine."

The government was also sanctioning 44 tankers that operate in Russia's "shadow fleet" transporting oil around the world, Reeves said in a joint statement with the Foreign Secretary Yvette Cooper.

The two Russian oil firms export 3.1 million barrels of oil per day. Rosneft is responsible for nearly half of all Russian oil production, which makes up 6% of the global output, according to the government.

Also on the sanction list is India's Nayara Energy Limited, which the government said imported 100 million barrels of Russian crude oil worth more than $5bn (£3.75bn) in 2024 alone.

Cooper said: "Today's action is another step towards a just and lasting peace in Ukraine, and towards a more secure United Kingdom."

The announcement comes as the G7, a grouping of some of the world's most advanced economies, prepares to consider a plan to effectively seize hundreds of billions from the proceeds of Russian investments, frozen since the invasion of Ukraine.

A vast bulk of Russia's assets are held as cash at the European Central Bank, after its underlying bond investments matured.

The European Union (EU), where the bulk of funds are held, had been reluctant to pursue the wider plan, but appears to be developing a way round legal concerns. It will be considered at an EU summit next week.

Ukraine has significant funding needs as the war continues, both in arms and reconstruction.

Earlier this year, the UK joined the US in directly sanctioning energy companies Gazprom Neft and Surgutneftegas.

At the time the then Foreign Secretary, David Lammy, had said it would "drain Russia's war chest – and every ruble we take from Putin's hands helps save Ukrainian lives".

.png)

3 hours ago

2

3 hours ago

2